The excessive consumption of sugar has caused widespread concern. In September 2021, Academician Chen Junshi pointed out at the "First China Drinks Healthy Consumption Forum" that replacing sugar with sweeteners is the development trend of the beverage industry. So, what are the current sugar replacement programs? Which sweetener is more promising?

General Counsel, National Center for Food Safety Risk Assessment

Low sugar, sugar replacement trend

Sugar is one of the most popular ingredients in the diet. Consumers are accustomed to the sweetness and texture, and enjoy the comfort and happiness from it. However, it is surprising that most sugar consumption comes from deep-processed foods and sugar-sweetened beverages, rather than desserts and candies.

At present, global consumers' attitudes towards sugar have changed: processed sugar is considered unhealthy, which has led to an increase in obesity rates around the world, while less refined sugar is considered clean and natural.

Global concerns about excessive sugar consumption and the increase in diseases have led to an increase in demand for low-sugar and low-sugar products. This situation has forced food and beverage formulators to put sugar reduction in the first place in product innovation, development, and marketing strategies. Similarly, sweetener manufacturers are also more in-depth research and development of sweeteners to replace sugar to cater to this highly active market demand.

Classification and key characteristics of sweeteners

The global sugar and sweetener market share are approximately US$25 billion (approximately RMB 161.1 billion), and this market has undergone tremendous changes in the past decade. More research and development are underway, including low-sugar, low-calorie sugar, high-sweetness sugar, artificial sugar, processed sugar, and natural sugar selection.

Generally speaking, sweeteners can be divided into the following six categories:

(1) Sugars: carbohydrates are naturally present in many foods, including fruits, vegetables, grains, and milk. The most common are sucrose, glucose, fructose, lactose, maltose, galactose and trehalose.

(2) Sugar Alcohols: A type of carbohydrates naturally found in plants and grains, albeit in small quantities. The human body cannot completely metabolize them, so they tend to have fewer calories per gram of weight. The most common are sorbitol, xylitol, mannitol, maltitol, erythritol, isomalt, lactitol, and glycerin.

(3) Natural Caloric Sweeteners: The oldest known sweeteners, including honey and maple syrup. They not only contain sugar, but also other nutrients. Their glycemic index is often lower than sugar. The most common ones are honey, maple syrup, coconut palm sugar, and sorghum syrup.

(4) Natural Zero-Calorie Sweeteners: They are not carbohydrates, they only contain few or no calories. In recent years, people's interest in this type of sweetener has increased day by day because they are good substitutes for artificial sweeteners. Their glycemic index is zero and they have an aftertaste. The common ones are stevia, allulose, mogroside, and brazzein.

(5) Modified Sugars: These sugars are usually produced by enzymatic conversion of starch, including modified sugars such as caramel or golden syrup. They are often used in cooking or processed foods. The most common are high fructose corn syrup, caramel, agave syrup, inverted sugar, and golden syrup.

(6) Artificial Sweeteners: Artificial sweeteners are usually called "high-intensity sweeteners" because their taste is similar to sugar, but their sweetness is as high as several thousand times. There are many types on the market, and some seem to be safer than others. They have been used in the United States and Europe for more than 120 years. The most common ones are aspartame, sucralose, saccharin, neotame, acesulfame K and cyclamate.

The key characteristics of sugar and sweeteners include sweetness (relative to sucrose), calorific value (calories per gram), taste, texture, volume, color (browning) and probiotic functions. Sugars, modified sugars and sugar alcohols are usually products with lower sweetness and standard calorific value (2~4 cal/g), while artificial sweeteners are products with higher sweetness and usually no calories.

Most of the research and development centered on sweeteners with high sweetness and low calories. Clean, pure and natural has become the driving force for the development of these sugars. However, price is still the biggest driving force for development and innovation in the sweetener and sugar fields.

The challenge and the key to development

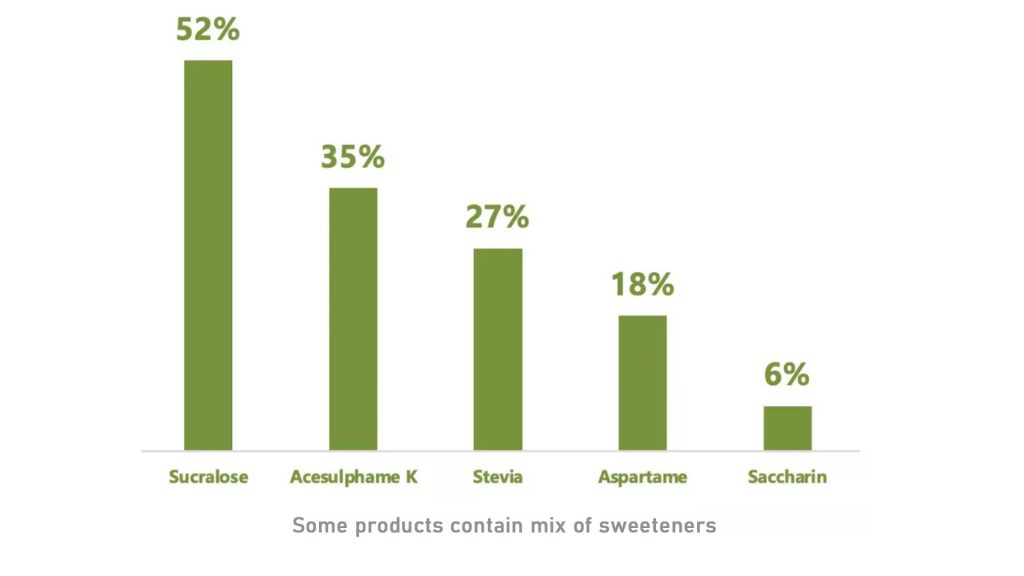

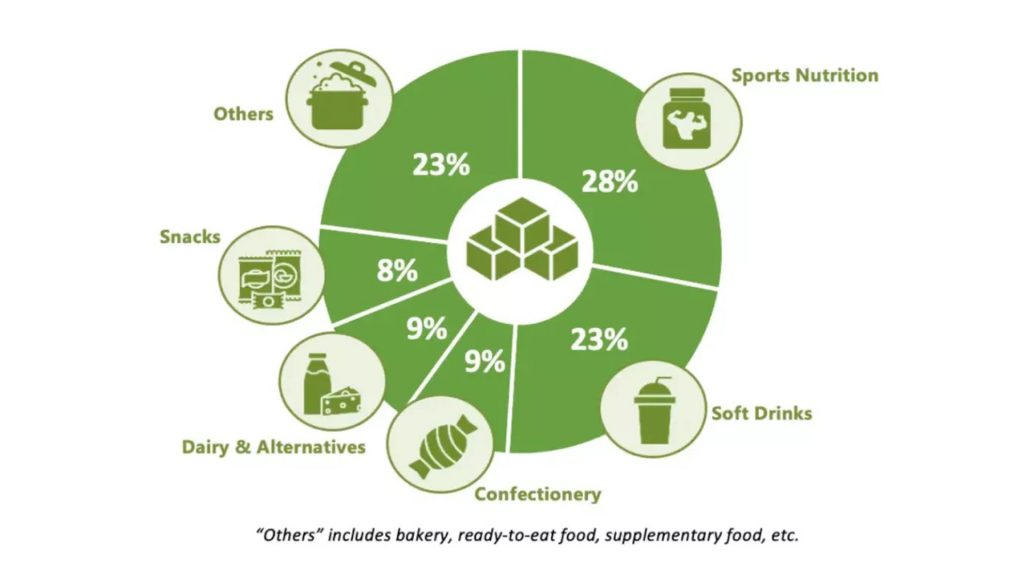

Since 2018, the market for high-intensity sweeteners has begun to grow, with a year-on-year growth of 12% in 2019. Although people are worried about the metallic odor and slightly bitter aftertaste brought by high-intensity sweeteners, high-intensity sweeteners are used in all major food categories, such as nutrition, baking, beverages, and candy.

Sweetener suppliers are under great pressure to provide the right solutions. Many suppliers have introduced new solutions that combine high-intensity sweeteners, rare sweeteners and low-intensity sweeteners. Multinational companies are helping their customers experiment with different product formulations through digital platforms to find the right taste and texture.

New product development is the key to the sweetener business. Most of the research and development of sweeteners are focused on sweetness, calorific value, taste, odor resolution, key functions and price competitiveness. Before expanding into commercial production, new products, application development, functional features (such as probiotic functions), feasibility, and product price models need to be tested.

Generally speaking, it takes 12 to 18 months for a company to develop any new process or new product containing new ingredients. In addition, for a new sweetener product, large-scale commercialization is relatively slow, because the market now has many options and alternatives.

With the development of the food industry in the direction of low-calorie, low-sugar, high-fiber, natural, organic, clean and healthy, more and more manufacturers are replacing sugar with sweeteners and natural substitutes without compromising taste. . Sweetener manufacturers are also studying rare sugars, such as fucose, kojibiose, cellobiose, brown sugar, etc., but these are still in the research stage, and the main challenges they face are product feasibility and formulation requirements.

Sweetener manufacturers are facing severe pressure to develop new products and need to provide correct solutions for formula makers around requirements such as taste, texture, cleanliness, and price. The natural sweeteners, allulose and stevia, are still untapped areas for many manufacturers, with promising prospects in the next five years.