Congestion in North America

"The traditional season of shipping is coming, but congestion at the ports of the USA has not eased, and now the Port of Oakland is overtaking LA/Long Beach as the center of congestion."

In a client replying on Wednesday, shipping giant Maersk warned that Los Angeles and Long Beach "remain stressed by an average of one to two weeks of waiting time for ships." But they said, "The situation is more severe at the Port of Oakland, where wait times are now up to three weeks."

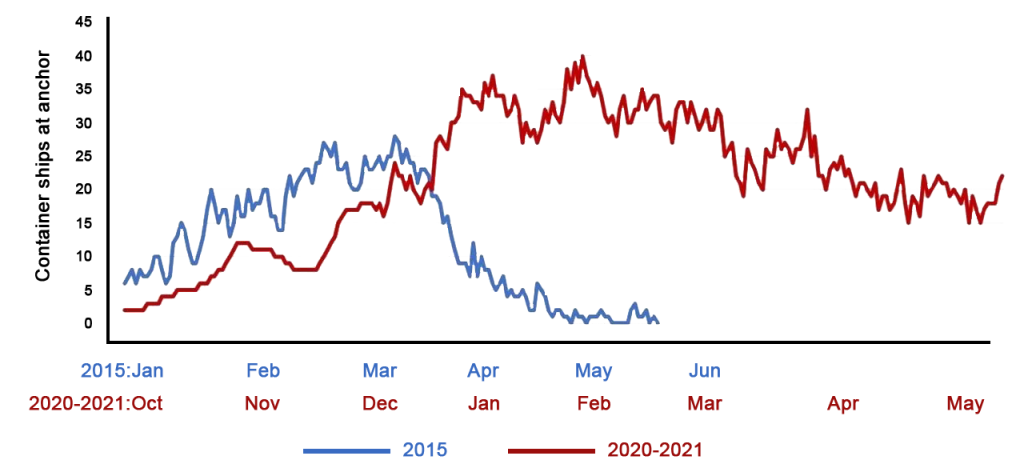

Los Angeles/Long Beach Congestion: 2015 versus 2020-2021

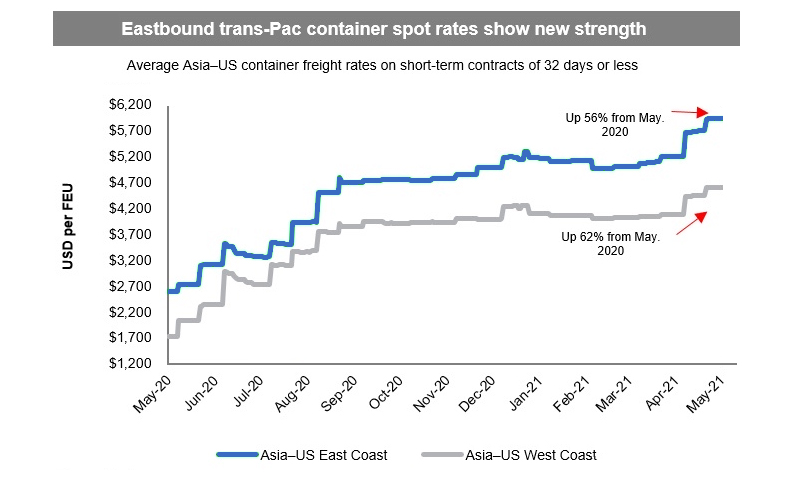

The importing level of the US from Asia has been at or near record levels for 10 straight months, which has been one-factor driving freight rates higher. Another factor is the "structural" suspension. The shipments were canceled because ships were delayed by a week or more at ports in the United States and Asia, thus missing planned rotations. Delays at ports on the west coast of the United States have had a serious impact on liner arrangements. According to data from Sea Intelligence Maritime Analysis, since Jan. 1st, 121 shipments to the West Coast and 21 shipments to the East Coast have been canceled.

According to Lars Jensen, CEO, and partner in Vespucci Maritime, the industry analyst, trans-Pacific eastbound shipping rates will jump again next month. If North American and Asian ports can address the root cause of rising rates -- port congestion -- rates will stabilize in the third quarter.

COVID-19 in India

As the COVID-19 worsens in India, Singapore, a shipping hub, was recently forced to ban seafarers from India and other South Asian countries. Seafarer rotation is again in crisis, adding to the strained global shipping capacity.

With a growing number of ports and airports closed to seafarers in and out of India, shipping companies say this leads to bottlenecks in crew shifts, and some are temporarily redeploying seafarers from other countries to replace Indians scheduled to board ships. But it is not as easy as it sounds, many of the best people are mostly from India. So, all of a sudden, we're losing important sources, and finding the right crew that meets the criteria is a pretty big problem.

Freight will soar

Retailers and NVOs will book until June, so availability is expected to be tighter next month than in May. If port and rail bottlenecks are resolved in late June and early July, the steady increase in rates will level off and rates could fall in the fourth quarter, Jensen said.

But all good predictions will be misplaced if US and Asian ports fail to address congestion, or if rising COVID-19 cases in India and Southeast Asia affect port operations in those regions.