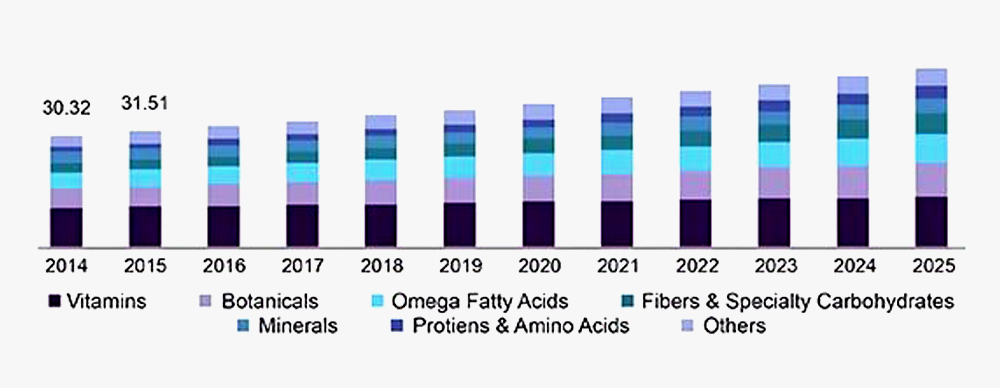

Dietary supplements have performed strongly in the past few years, and according to Grand View Research, the global dietary supplement market is expected to grow at a compound annual growth rate of 7.8% by 2025. Changes in global consumer habits and increased health awareness are creating new opportunities for dietary supplement brands. In addition to common vitamins and minerals, plant ingredients, amino acids, and proteins are expected to grow.

U.S. dietary supplements market share,by ingredient,2014-2025(USD Billion)

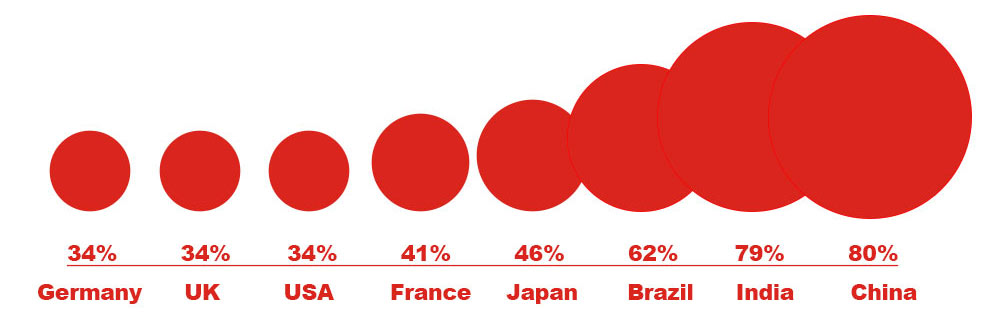

Market analysts predict that this year will be a bumper year for nutritional supplements and functional foods around the world. Regionalization is taking shape. Which countries or regions are the ideal target markets for specific ingredients?

Asia Pacific: Plant ingredients, dairy alternatives grow rapidly

According to Grand View Research, the Asia-Pacific region is one of the fastest-growing markets for dietary supplements, driven by GDP growth and an aging population. Another market analyst, Kenneth Research, predicts that by 2024, overall sales of dietary supplements in the Asia-Pacific region will grow at a compound annual growth rate of 11.2%, 2.4 percentage points higher than the projected global average.

Kenneth Research pointed out that herbs such as turmeric and African drunk eggplant are the main driving forces in the Asia-Pacific region, and it is expected that tofu, tofu ingredients and milk substitutes will also perform well. According to Market And Market research, in 2018, the Asia Pacific region accounted for the largest share of the global dairy alternative market. The two major factors driving market growth are increased consumer purchasing power and increased soy milk consumption. In addition, busy consumers in the Asia-Pacific region are looking for nutritionally fortified products, trying to supplement their diet in a convenient way. The dairy substitute market in the Asia-Pacific region is expected to grow rapidly, with dairy-free yogurt dominating.

Another important market in the Asia Pacific region will be protein and amino acid supplements. India's Mordor Intelligence predicts that by 2024, the whey protein market in the Asia-Pacific region will reach $ 1.57 billion, with a compound annual growth rate of 9.2%. Amino acids and proteins are still safe choices at home and abroad.

Europe: Strong protein performance

Overall, Europe will continue to be the dominant market for nutritional supplements. Mordor Intelligence estimates that by 2024, the European market will grow at a compound annual growth rate of 4.6%. Two key factors driving the development of the European market are the recommendations of health professionals and the Europeans generally have a positive view of supplements.

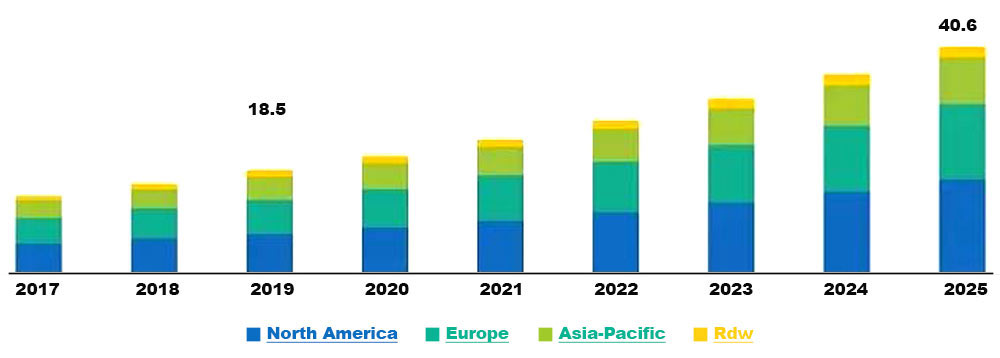

According to Markets and Markets, the global plant protein market is expected to be worth $ 18.5 billion in 2019, and is expected to grow at a compound annual growth rate of 14.0% from 2019 to reach $ 40.6 billion by 2025.

Europe and North America are expected to become the two main markets for plant protein. Fortune Business Insights research shows that by 2025, Europe and North America will account for more than half of the global plant protein product revenue.

Plant-Based Protein Market (USD Billion)

Common plant proteins include soy protein, peanut protein, and oat protein. At present, some emerging plant proteins are emerging, such as chickpea protein, pea protein, and seaweed protein.

North America: Sports nutrition products begin to focus on clean labels

North American demand for sports supplements continues to grow, with Canada and the United States leading the market. Euromonitor predicts that the compound annual growth rate of protein products in the United States alone will reach 12%.

Since the outbreak of the Clean Label Campaign in Britain more than 20 years ago, more and more consumers have begun to focus on simpler and healthier foods. In order to meet consumer demand, food companies have gradually attached importance to clean labels.

According to Lumina Intelligence, clean label sports nutrition products are expected to grow, although costs are on average 26% higher than competing products. Lumina noted that in the United States, competition has reduced the price of clean-label sports nutrition products. In contrast, Chinese consumers are more willing to spend large amounts on clean-label sports nutrition products.

Argentina, Middle East: collagen increases

Euromonitor International data shows that this year, the overall market of nutritional supplements in Argentina will grow 27.2% over last year. At the same time, Euromonitor reported that the overall market growth rate of Turkey and Pakistan will be slightly higher than 20%, in these three countries, collagen is expected to become the main market driver.

Mordor Intelligence predicts that the compound annual growth rate of the South American nutrition food market will reach 7.5% in 2023. At the same time, in the same forecast period, sales of nutritious food in the Middle East and Africa will grow faster. The compound annual growth rate will reach 7.8%. As more and more Middle Eastern and South American consumers become familiar with collagen and other beauty products, the nutritional food market may grow further.